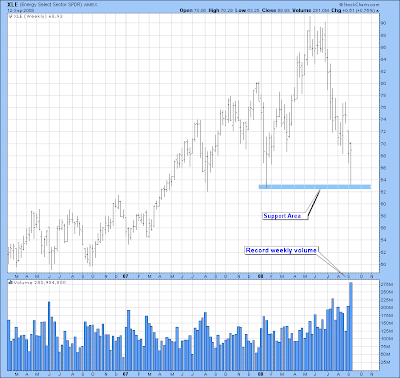

Huge Volume in Energy ETF

Energy stocks have been selling off sharply since June but may be in the process of putting in a bottom.

In the above weekly chart of XLE (energy ETF) you'll notice that a support level is being tested. You'll also notice that XLE just broke a record for having its largest weekly volume since this ETF began trading.

I think the combination of price support and large volume is a sign that this ETF could be in the process of establishing a bottom. A move above last week's high would be quite bullish in my opinion.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_4.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

stocks

trading

stocks

trading

2 comments:

I have been on oil for sometime now trying to trade it , but it appears to me to be a falling knife. Now that the hurricane is coming out of the price of oil I would personally feel we need to see capitulation in this sector prior to doing much of anything .

mj

Kevin,

Can you contact me when you get a chance, I'd like to see if we can start working together.

Best,

Brad

www.ino.com

Post a Comment