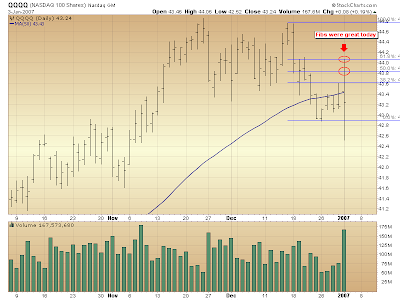

QQQQ...Nasdaq Retracement Levels Hold

Last week I commented that usually markets retrace 50% of a bearish engulfment before heading back down. I said I was waiting for a rally to short QQQQ at 50%.

Well we got the rally and I shorted some at 50% and at .618.. The fibonacci levels held perfectly and I pretty much shorted the highs today in QQQQ. This is one of my favorite trades and works more times than not with amazing accuracy. It's not often I make a dollar profit in QQQQ in just one day. The market fell out of bed in the afternoon but managed to bounce a little going into the close. QQQQ closed below its 50 day moving average on good volume and a large trading range for the day.. I'm going to hold this trade and see how much more downside there is if any.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_4.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

stocks

trading

stocks

trading

7 comments:

Nice trade!

Hey Zen...Did you delete some of your earlier posts today?

No why?

I looked at your blog this morning and thought I saw a post on a weak december is bullish for the nasdaq in January for the first 3 days. I was going to post the link on my blog.

its there, just have to scroll down a bit.

http://zentrader13.blogspot.com/2007/01/santa-in-january.html

kevin, do the fib. lines become stronger resistance as the QQQQ,s bounce off and reverse? great posts, Thanks, Chris

I think the more times any level is tested it actually becomes weaker. Think of support or resistance as a wrecking ball smashing into a wall. The more times the wrecking ball hits the wall, the weaker it gets.. I feel support and resistance works the same way. If QQQQ were to rally back up to the .618 retracement, I would be hesitant to short it again.

Post a Comment