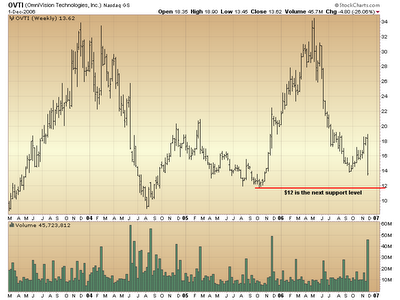

OVTI

Bearish News sent OVTI to a new low for the year..The next level of support I see is last year's low around the $12 area...

OVTI OmniVision reports Q2 earnings, issues Q3 guidance (16.29 -0.32)

Reports Q2 (Oct) earnings of $0.28 per share, excluding stock based compensation and a one-time litigation settlement expense, $0.02 worse than the First Call consensus of $0.30, which also excluded stock based compensation and litigation expenses; revenues rose 8.6% year/year to $137.7 mln vs the $139.82 mln First Call consensus. OVTI reports gross margin 33.1% vs 32.5% street expectation. Co issues guidance for Q3, sees EPS of $0.16-0.23, excluding stock based compensation, vs. $0.33 First Call consensus; sees Q3 revs of $135-145 mln vs. $146.65 mln First Call consensus. OVTI was also downgraded today by Longbow and Baird.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_4.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

stocks

trading

stocks

trading

2 comments:

Kevin,

Do you expect this weakness to be short-lived? or is this the beginning of the downward spiral?

what about the take over rumor... or was it a classic "pump and dump" tactic before the earning...

Thx in advance for your thought.

I think OVTI is going to test last years low at $12..I try not to think too much because usually the opposite happens..I just want to follow along with the market as best as I can.. Let the stock do the talking.. OVTI just took out support on good volume so in my opinion the next move will be to $12 which is the next support level. Just keep it simple

Post a Comment